Background

Vera Solutions has designed and built Amp Impact based on 8+ years and 50+ implementations of portfolio-level impact management systems (not to mention 150+ related implementations tracking individual program- or enterprise-level impact). As a Certified B Corp, Vera is committed to amplifying the impact of organizations of all sectors, geographies, and sizes.

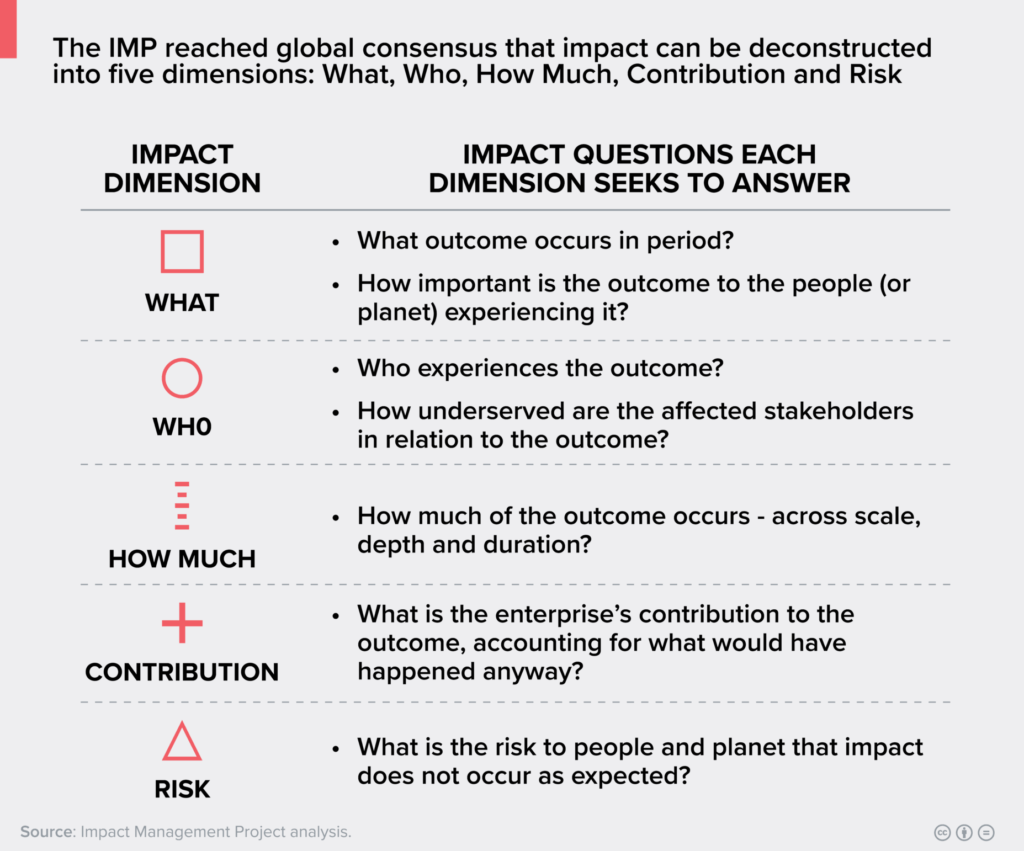

Vera endorses the Impact Management Project’s (IMP) definition of impact as the “positive and negative changes in outcomes for people and the planet” resulting from enterprises’ activities. Vera believes that this definition transcends sectors – that it applies equally for nonprofits and traditional grant-makers, for governments and government-funded initiatives, for social enterprises and impact investors, and for profit-driven enterprises and investors.

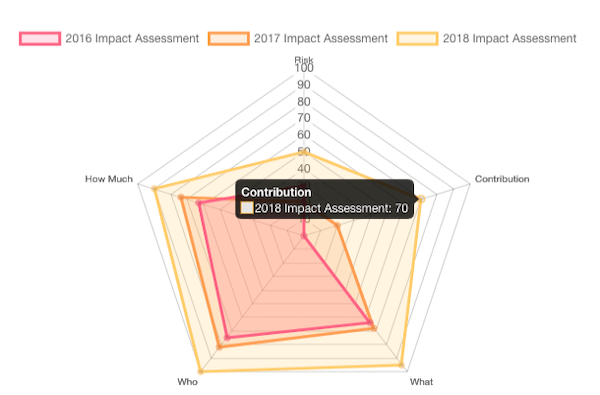

Through a consensus-building approach with over 2,000 organizations across a three-year period, the IMP has deconstructed impact into five dimensions, which enterprises and investors can use to fully understand their impact performance. The IMP defines them as follows:

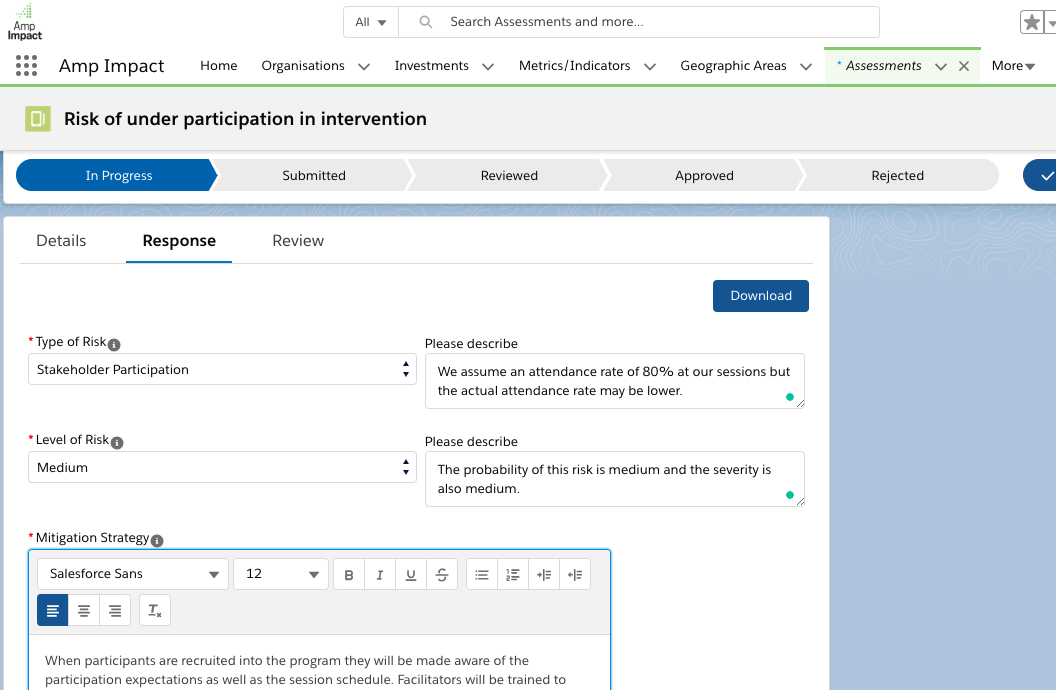

Built on Salesforce – the world’s most customizable platform – Amp Impact has been designed to be flexible and accommodate the different ways in which investors manage impact. Amp Impact’s core data model and features are aligned with the five dimensions: the relational structure between Objectives, Indicators, Results, Geographic Areas, and other data objects creates a powerful and common-sense way of assessing three of the impact dimensions: ‘What’, ‘Who’, and ‘How Much’ while Amp’s narrative Submission features allow for assessment of ‘Contribution’ and ‘Risk’ (as well as qualitative assessment of the other dimensions).

In this document, we highlight how each dimension can be addressed using out-of-the-box (OOB) Amp Impact features or simple Salesforce configuration.

How Amp Impact addresses each IMP impact dimension

Impact Dimension

OOB Amp Impact Functionality

Additional Configuration

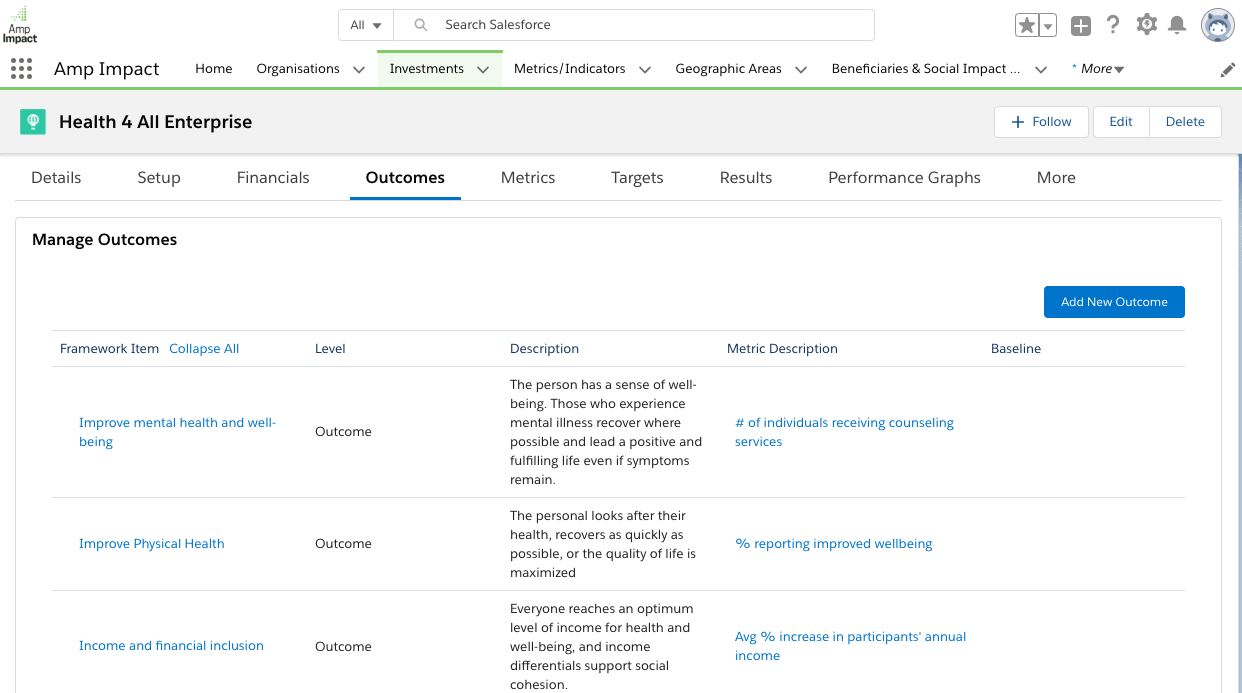

- Indicators can be connected to one or more Outcomes / Objectives.

- Thematic Areas can also be used to tag Investments with high-level outcomes and the SDG Plug-in can be used to connect an Investment to its related SDGs.

- Outcome thresholds can be set either using Targets and optionally using Amp’s Indicator Stoplight Thresholds.

- Intended vs unintended

- Positive vs negative

- Importance or weight

- Geographic Areas allow for geographic disaggregation and analysis of Results at any level (facility, community, neighborhood, city, district, province, country)

- Thematic Areas can be used to tag an Investment with different types of Beneficiary Groups.

- Disaggregation Values can separate Results across types of Beneficiaries (e.g. income level, age group, rural/urban, etc)

- Cross-disaggregation allows for Result data to additionally be broken down by sex or gender.

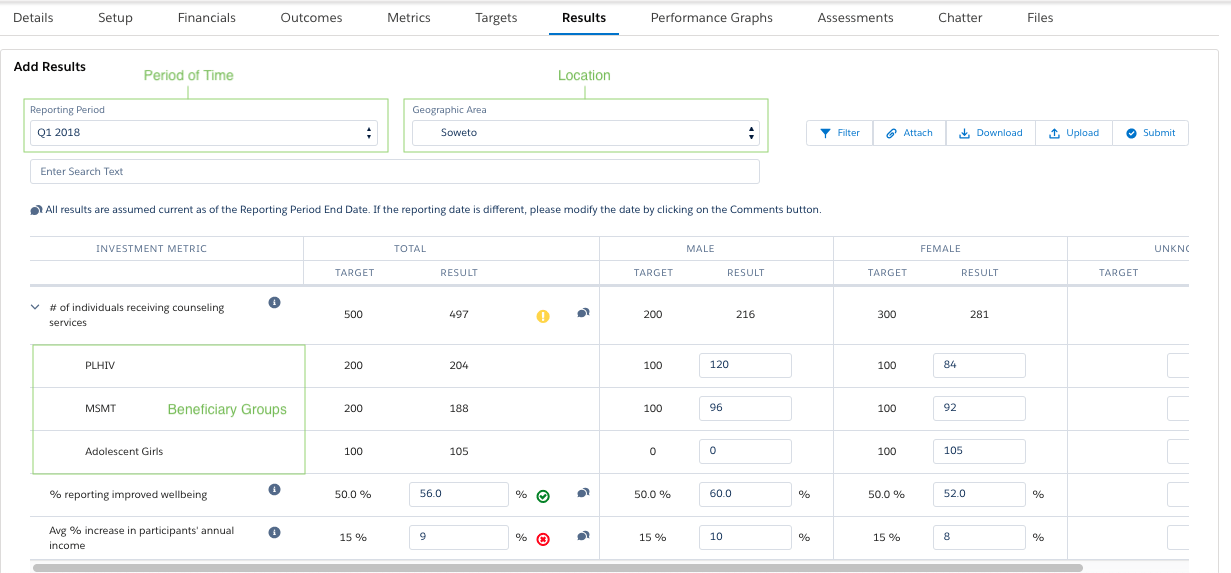

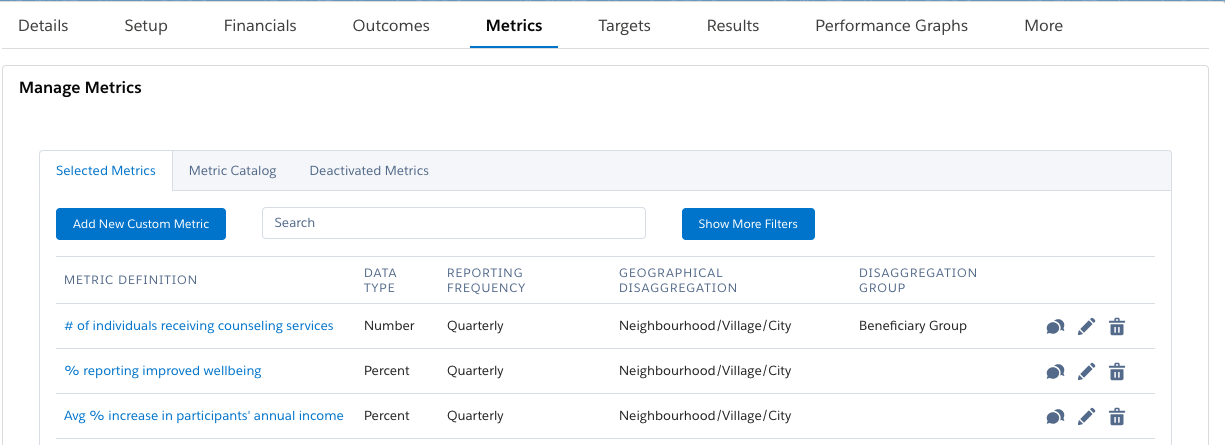

Amp Impact has robust, flexible indicator management functionality that enables users to define metrics used to measure ‘How Much’ impact an investment generates.

- Available Data Types: numbers, percentages, currencies, milestones, or qualitative.

- Indicators can be classified by Level (impact, outcome, output) and by Type (e.g. scale vs depth).

- Results can be input, calculated from other indicators, or aggregated from other data in Salesforce.

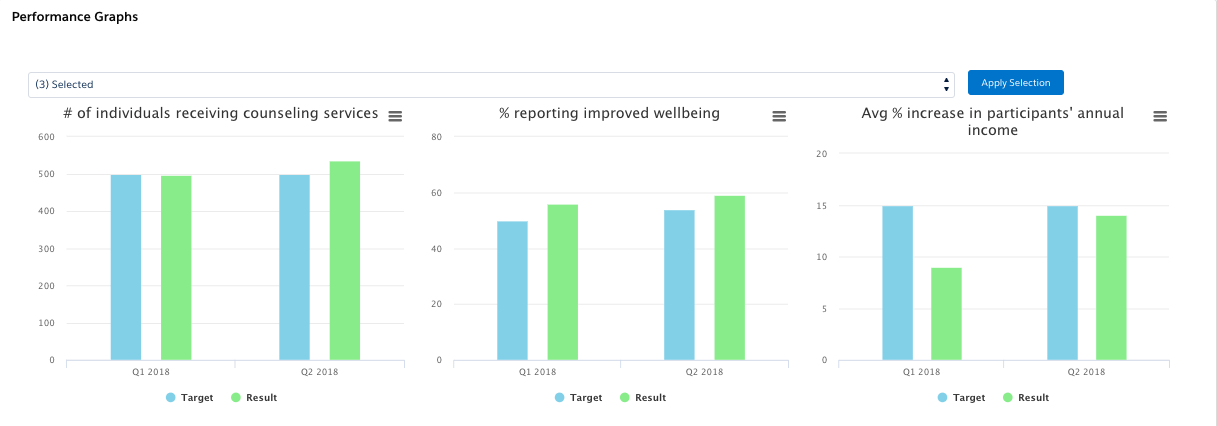

- Duration of an outcome is measured by tracking an Indicator’s Results over time, across Reporting Periods.

Often, achievement of Scale for an outcome will be captured with different indicators than achievement of Depth.

Salesforce Reports and Dashboards can be configured to slice and dice Result data, show scale and depth of impact over time, broken down by outcome, by thematic area, by beneficiary group, etc.

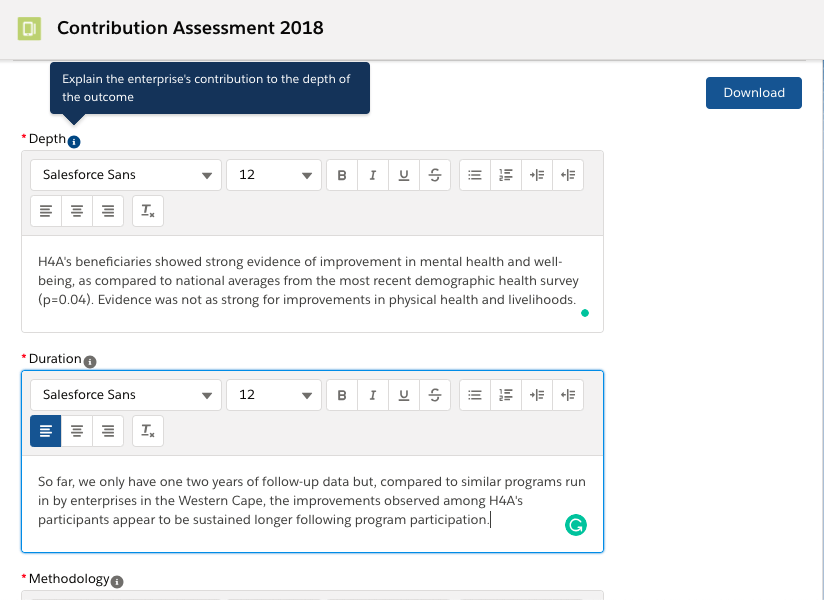

- Narrative Submissions can be used to capture findings from evaluations and research, or explanations of the expected counterfactual depth and duration of impact.

Capturing impact dimensions in Amp Impact